Massachusetts Foreign Llc Registration

Definition synonyms and fees.

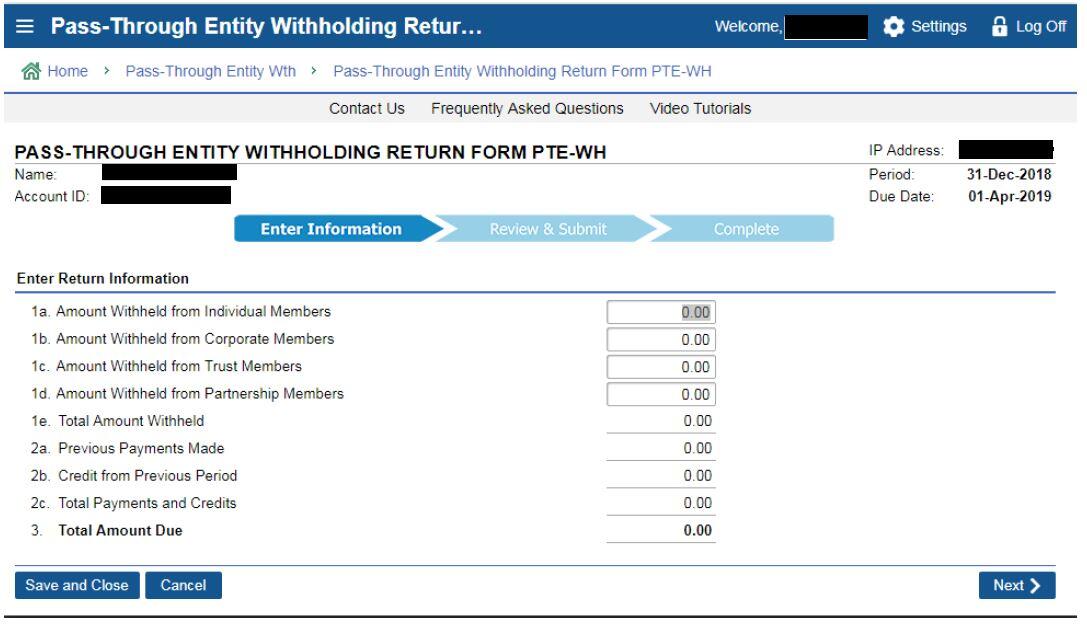

Massachusetts foreign llc registration. Llcs and llps are classified for massachusetts tax purposes the same way they are for federal income tax purposes. Limited liability partnership domestic and foreign must file a certificate of withdrawal. Limited liability companies must file a certificate of cancellation domestic or certificate of withdrawal foreign. The foreign limited liability company application for registrations costs 500 to file.

Foreign llc registration or foreign llc qualification is the term used when an llc formed in one state is registering to do business in a new state. We would like to show you a description here but the site won t allow us. Matt horwitz on june 1 2017 last updated. Do you want to dissolve your llc or llp.

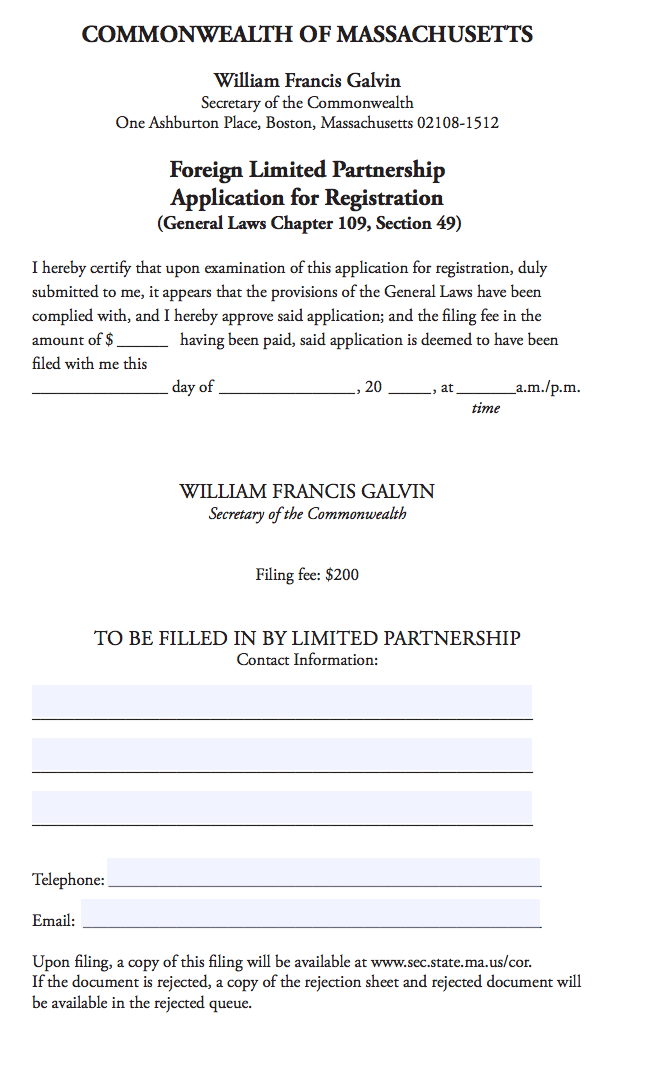

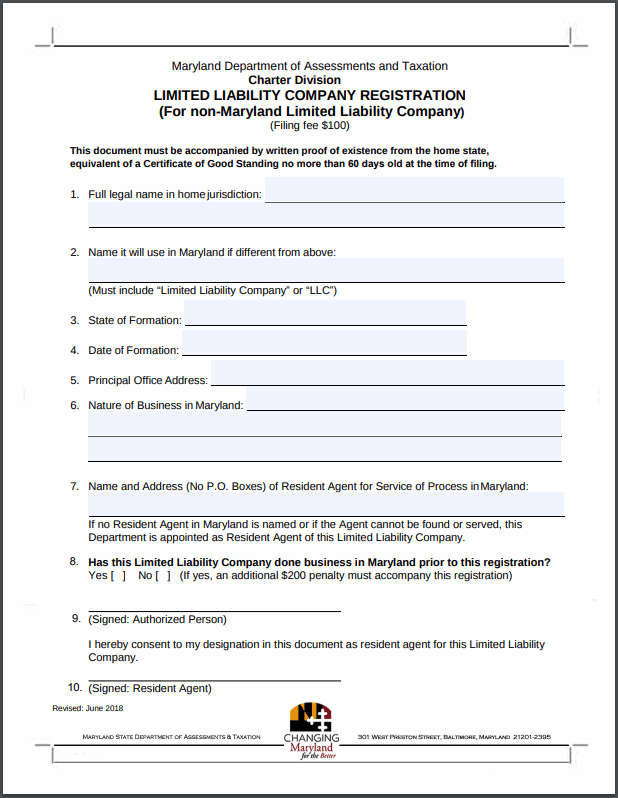

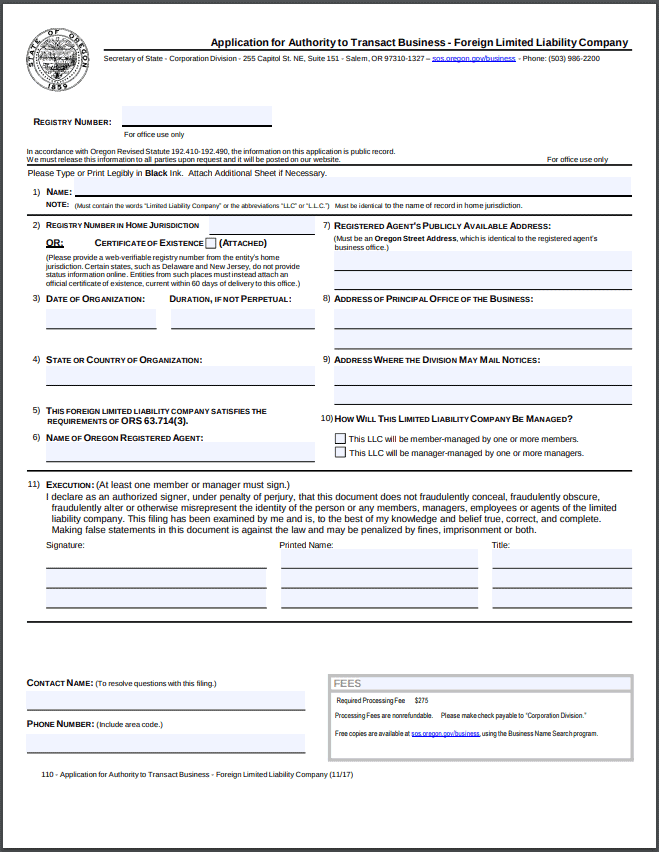

Foreign llc registration fees for all 50 states are listed in the table below. January 15 2020 foreign llc. Registering a foreign corporation in massachusetts. This process is called foreign qualification and it involves filing foreign limited liability company application for registration form llcs or foreign corporation certificate of registration form corporations with the massachusetts secretary of the commonwealth.

Officers directors a name and business address for the current officers and directors will be provided. Closing your business dept. Form your own limited liability company nolo 2019 covers all the initial steps including articles. A single member llc will be disregarded as an entity separate from its owner for massachusetts income tax purposes if it is disregarded for federal tax purposes.

The massachusetts foreign corporation certificate of registration form ffpc is a standard form which a foreign entity must file with the massachusetts secretary of the commonwealth when it wishes to conduct corporate business in the commonwealth of massachusetts the certificate of registration must be filed within ten days of starting to conduct business in massachusetts. Foreign llc fees by state written by. You will however have to use a different application form foreign corporation certificate of registration. To register a foreign llc in massachusetts you must file a massachusetts foreign limited liability company application for registration with the secretary of the commonwealth of massachusetts you can submit this document by mail by fax or in person.

On the foreign corporation certificate of registration in massachusetts you will list a brief description of the activities to be conducted by the corporation.