Foreign Earned Income Tax Worksheet 2019

Tax on the amount on line 2c.

Foreign earned income tax worksheet 2019. The foreign earned income exclusion allows expats to exclude the first around 100 000 of their income from us taxation. Citizen who is a bona fide resident of a foreign country or countries for an. If any of the foreign earned income received this tax year was earned in a prior tax year or will be earned in a later tax year such as a bonus see the instructions. Beginning with tax year 2019 all taxpayers will be required to use the form 2555 to claim the foreign earned income exclu sion.

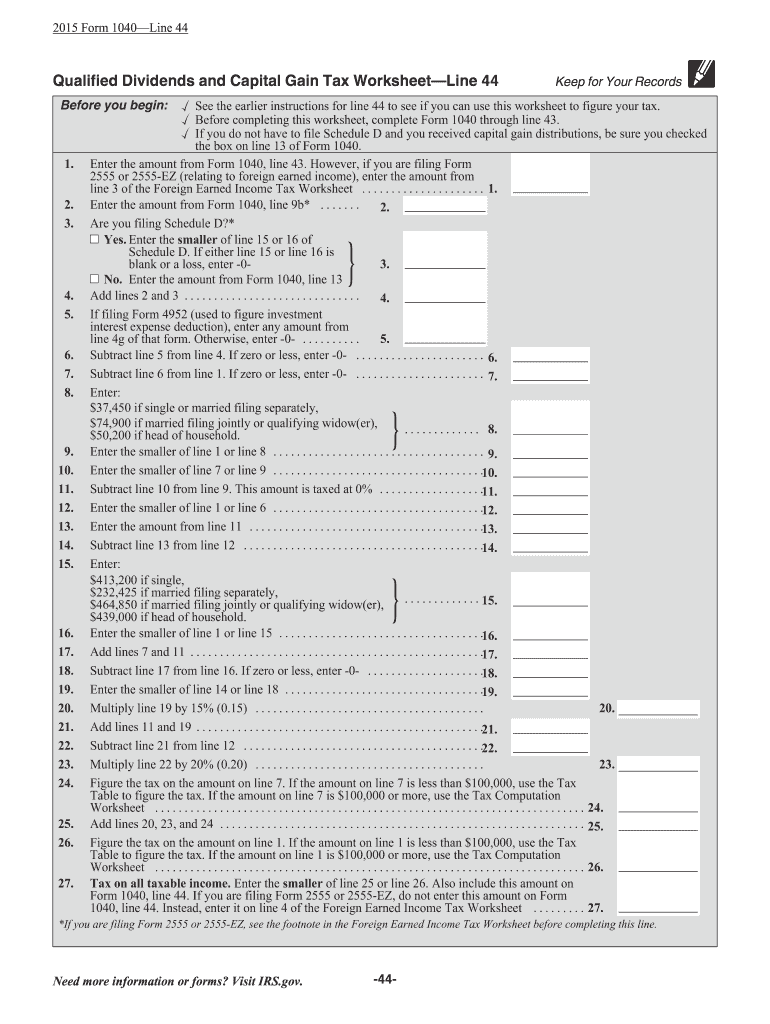

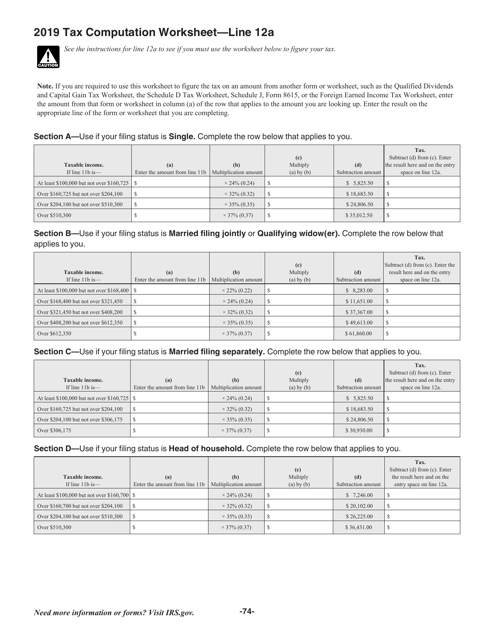

Foreign earned income tax worksheet form 1040 instructions html. Use the tax table tax computation worksheet qualified dividends and capital gain tax worksheet schedule d tax worksheet or form 8615 whichever applies. Beginning with tax year 2019 all taxpayers will be required to use the form 2555 to claim the foreign earned income exclusion. Do not use a second foreign earned income tax worksheet to figure the tax on this line 4.

Standard deduction amount increased. If the amount on line 2c is 100 000 or more use the tax computation worksheet 5. If you meet certain requirements you may qualify for the foreign earned income exclusion the foreign housing exclusion and or the foreign housing deduction to claim these benefits you must have foreign earned income your tax home must be in a foreign country and you must be one of the following. 2013 foreign earned income tax worksheet.

The form 2555 ez will no longer be avail able to make the election to exclude foreign earned income and the foreign housing cost amount. Since you are excluding 105 900 of your 150 000 gross receipts you will need to multiply that same ratio by the expenses that are directly related to your schedule c gross receipts as follows. Foreign earned income tax worksheet form 1040 instructions html. 2012 foreign earned income tax worksheet.

One advantage of the foreign earned income exclusion is that it doesn t matter whether an expat is paying foreign taxes or not so expats who don t pay foreign taxes such as those living in zero income tax jurisdictions or digital nomads who freelance while roaming. For 2019 the maximum exclusion amount has. Subtract line 5 from line 4. The form 2555 ez will no longer be available to make the election to exclude foreign earned income and the foreign housing cost amount.

See the instructions for line 11a to see which tax computation method applies. If the amount on line 2c is less than 100 000 use the tax table to figure this tax. Your 2019 tax year for services you performed in a foreign country. While the foreign earned income tax worksheet is linked to federal form 1040 it is only used if there is foreign earned income in the return if the return is reporting an amount on form 2555 line 45 for the foreign earned income exclusion if form 2555 does not apply to the return the tax amount will be determined directly from the tax tables put out by the irs or schedule d form 1040.