Foreign Taxpayer Identification Number

The jurisdiction specific information the tins is split into a section for individuals and a section for.

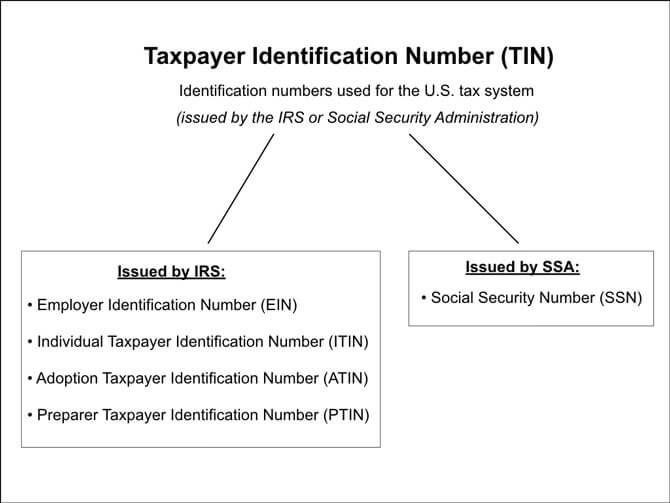

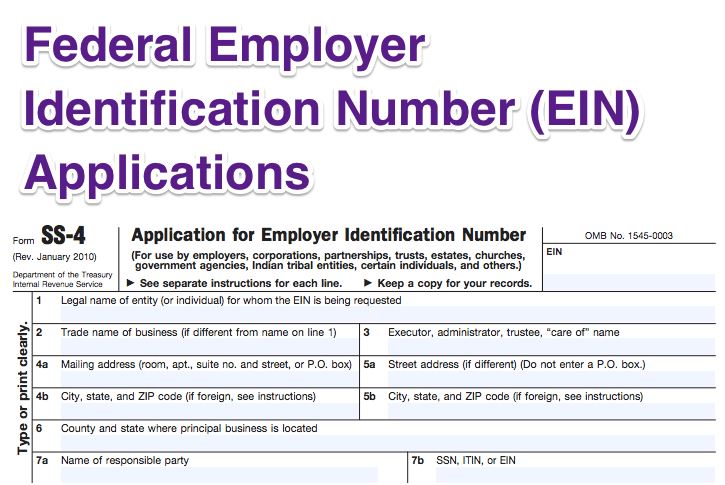

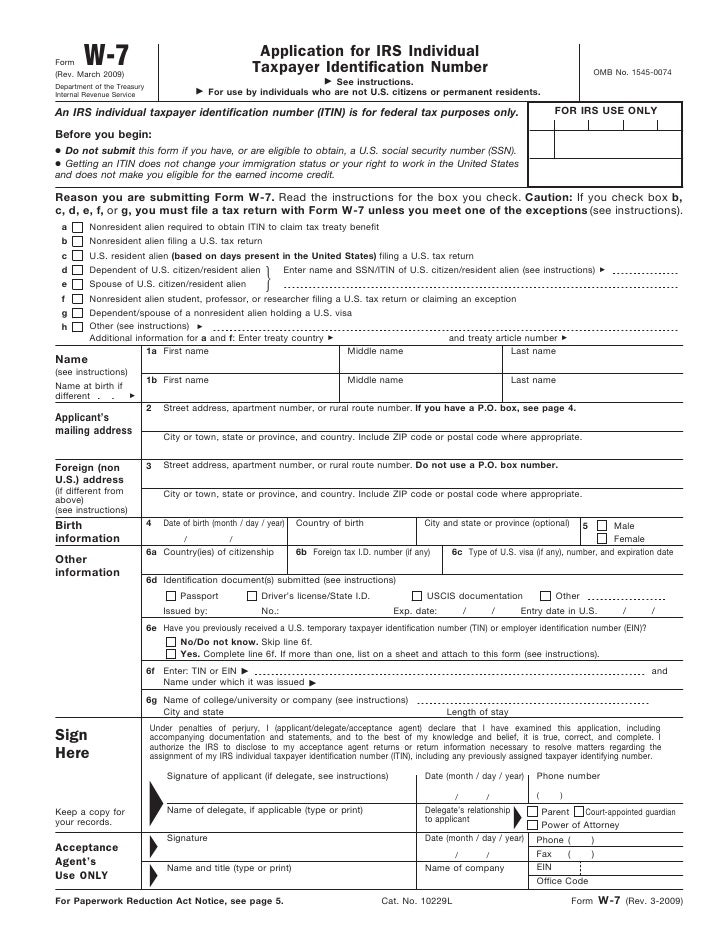

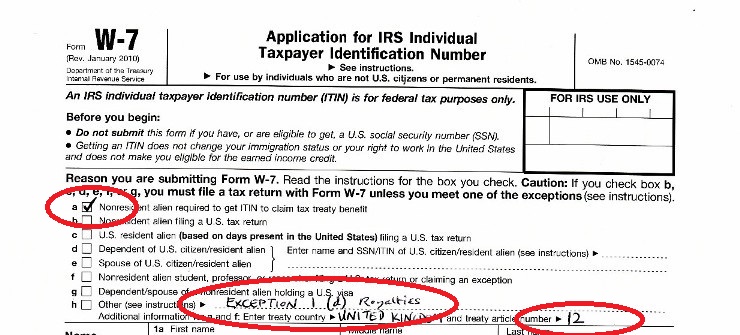

Foreign taxpayer identification number. Immigration law are eligible to apply for a social security number ssn. Identification tin is issued by local tax office according to relevant rules. Foreign entities that are not individuals i e foreign corporations etc and that are required to have a federal employer identification number ein in order to claim an exemption from withholding because of a tax treaty claimed on form w 8ben need to submit form ss 4 application for employer identification number to the internal. Generally aliens may apply for either a social security number ssn or an individual taxpayer identification number itin for use on tax related documents.

For individuals it is determined on the basis of personal data and is made up of an expression of 16 alphanumeric characters. Foreign tax identifying numbers foreign tin are. This section provides an overview of domestic rules in the jurisdictions listed below governing the issuance structure use and validity of tax identification numbers tin or their functional equivalents. Unique taxpayer reference utr the utr may be found on the front page of the tax return form sa100 as shown in the example below.

In some regions passport numbers are also recognized as tin for foreign individuals. Coding for the identification number for tax payers gonggao 2015 66. The tax identification number provides a means of identification of foreign citizens in their relations with public authorities and other administrations. Coding for the identification number for tax payers shuizongfa 2013 41 revision of.

Both identifiers are unique and personal to the individual concerned.