Obtain Ein For Foreign Entity

Those foreign entities filing form ss 4 for the purpose of obtaining an ein in order to claim a tax treaty exemption and which otherwise have no requirements to file a u s.

Obtain ein for foreign entity. Are american citizens or residents of this country. How to obtain a tax id number for a foreign entity. Income tax return employment tax return or excise tax return should comply with the following special instructions when filling out form ss 4. If you re a foreign person an ein allows you to start a business in the united states even if you don t have a social security number.

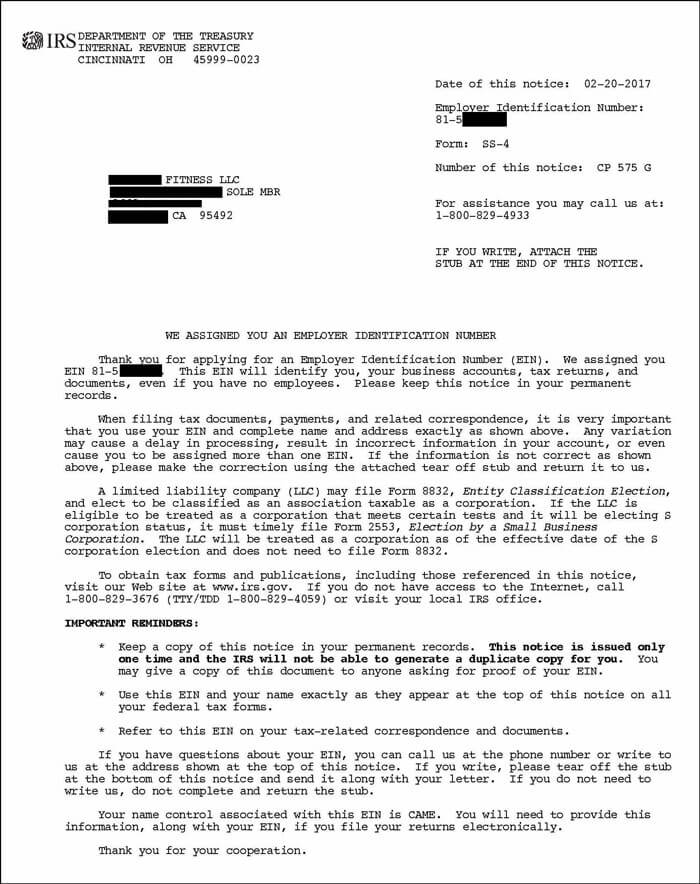

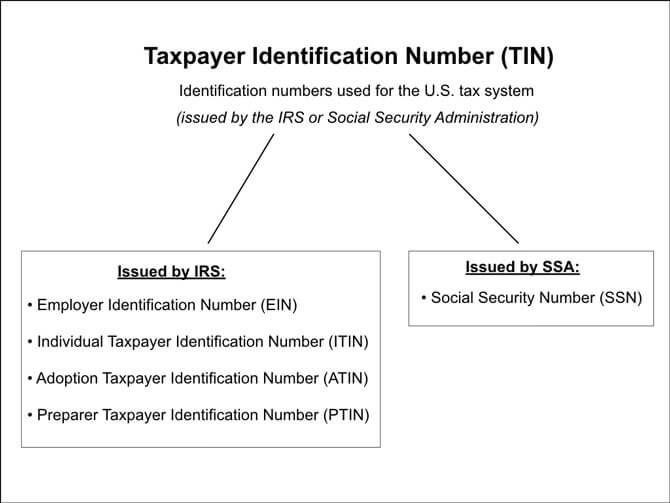

An employer identification number or ein is an identification number issued to organizations to identify who must file a business tax return. An employer identification number ein allows the irs to keep track of a business tax reporting. Complete the third party designee section only if you want to authorize the named individual to receive the entity s ein and answer questions about the completion of form ss 4. A tin is also known as an employer identification number ein.

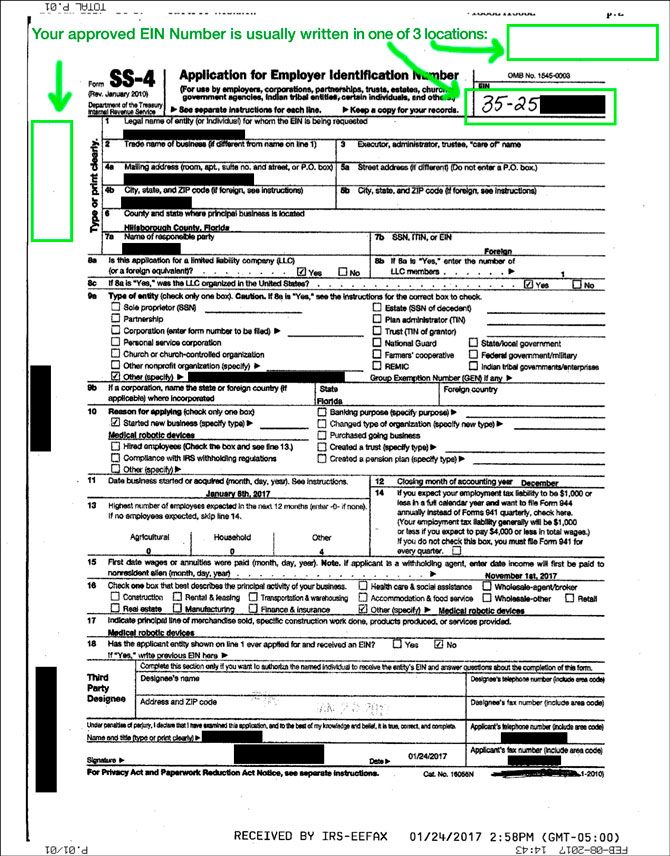

Fill out form ss 4 to obtain a tin for a foreign business entity. Somewhat confusingly form ss 4 is used even if there are no employees. Tins for entities a u s. Tin that a foreign vendor may obtain depends on a variety of factors.

Eins can also be used by. The type and method of applying for a u s. Registered business entities must obtain an employer identification number ein from the irs. Form ss 4 is available for download from the irs website see the link in the resource section.

The person making the call must be authorized to receive the ein and answer questions concerning the form ss 4 pdf application for employer identification number. Recently the rules for form ss 4 were changed causing some uncertainties in cases where non u s. For entities the number obtained is called an employer identification number ein and is applied for on irs form ss 4. For foreign owned entities the process of obtaining an ein can be complicated and confusing.

There is no requirement that the owners of an entity registered in the u s. Tin for an entity is an employer identification number ein even if the entity has no employees in the united states. An ein is the tin for all types of entities with a federal tax administrative. Which leaves foreign individuals who can t obtain either wondering how to get an ein without an ssn.

The internal revenue service distinguishes business entity tax filings by the use of employer identification numbers.