Foreign Mutual Funds Pfic

Tax rules applied to domestic mutual funds.

Foreign mutual funds pfic. The purpose of the rule is to ensure the irs get its proper piece of the tax pie. What is a pfic. The qualified electing fund tax regime operates parallel to the u s. If the fund is a partnership or trust then it won t be a pfic.

Taxpayers is punitive and complex pfics encompass a wide variety of non u s. Or a pfic may be comprised of at least 50 passive investment assets. A key point to understand is that mutual funds from u s. When it comes to individual investors one of the most common types of pfic is ownership of a foreign mutual fund.

If however you open a foreign fund with ubs a swiss investment company that fund would be considered a pfic. Because nearly all of the income garnered from mutual funds is passive income these funds are almost always viewed as passive foreign investment companies. Foreign mutual funds are pfics. You can generally tell if a foreign corporation or foreign.

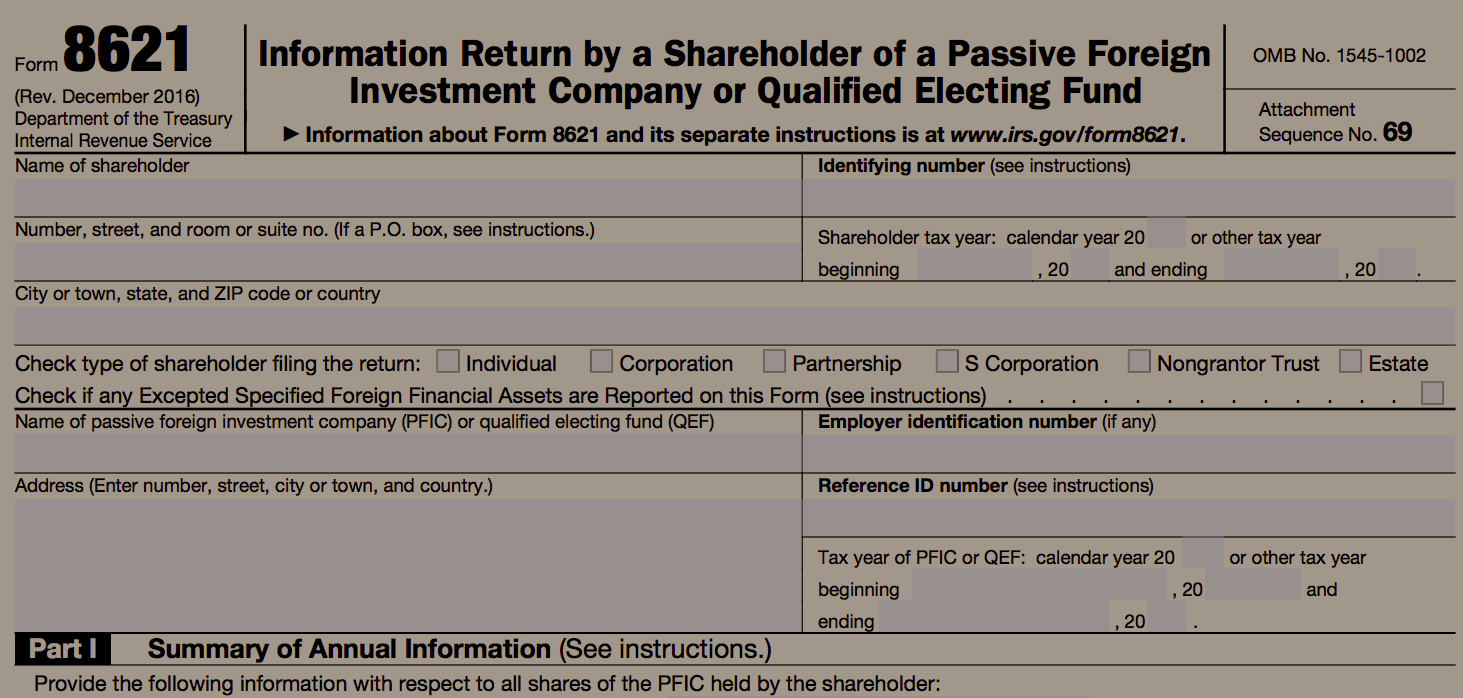

This allows domestic and foreign funds to receive similar tax treatment. Foreign mutual funds typically are considered pfics if they are foreign corporations that generate more than 75 of their income from passive sources such as capital gains and dividends. Person owns funds overseas the resulting tax can be dizzying a foreign mutual fund is generally referred to as a passive foreign investment company the foreign mutual funds pfic analysis is very complicated because it involves several moving parts simultaneously. Pfic is the passive foreign investment company regime.

Foreign mutual funds pfic foreign mutual funds pfic. A common investment related income tax issue encountered by u s. Citizens living abroad or u s. This is because the irs wants to make sure they get their chance to tax the foreign mutual fund in accordance with the pfic anti deferral of tax regime.

A pfic is defined as any foreign corporation that derives 75 or more of its income from passive activities. Qef election income received from pfic shares is subject to annual taxation. Taxpayers owning foreign mutual funds. Reporting foreign mutual funds.

Taxation of foreign mutual funds pfics owned by u s. You have to look however to be sure. Permanent residents green card holders is owning foreign investment funds. These foreign investment funds are classified as passive foreign investment companies pfics.

Companies with international investments like vanguard for example are generally not considered pfics. It is a near certainty that mutual funds outside the united states are organized as corporations.

:max_bytes(150000):strip_icc()/101535182-5bfc397046e0fb0026054ab6.jpg)