Foreign Importer Of Record Cbp

Be an active u s.

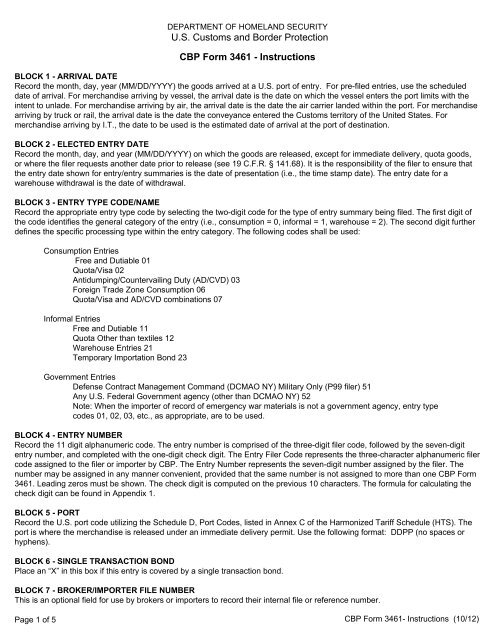

Foreign importer of record cbp. A has a resident agent in the state where the port of entry is located who is authorized to accept service of process against that corporation or in the case of an entry filed from. The customs modernization act of 1993 created the importer of record. The united states unlike some other countries permits a non resident corporation to act as an importer of record for shipments of merchandise from that company to the united states. Importer of record ior number in one of the following formats.

On behalf of the foreign corporation s behalf. The foreign shipper must obtain a foreign entity customs bond by a us customs broker through a freight forwarder or a surety company either single entry or annual continuous. A foreign based importer of record the use of a blank ultimate consignee field will result in a foreign based ultimate consignee. Can a foreign company export to the united states without an importer of record based in the u s.

On behalf of the foreign corporation s behalf. Is a company that sells tropical fruits to the u s. Customs and border protection. Can a foreign company export to the united states without an importer of record in the u s.

Have and maintain an active u s. Social security number internal revenue service assigned id s or cbp assigned importer id. The actual ownership of the goods are transferred to the importer of record temporarily until the goods are taken out of customs and delivered to the actual owner. For instance a customs broker that has been named in a customs and border protection s power of attorney may make entry on behalf of.

As explained by the cbp the answer is yes your company must have an agent in the state where the port of entry is located that serves as resident agent in the u s. Importer or non resident canadian importer. In a ddp shipment the importer of record is the foreign shipper of the goods. Active is defined as having imported goods into the u s.

The importer of record carries the legal responsibility for the initial valuing. A nonresident corporation i e one which is not incorporated within the customs territory of the united states or in the virgin islands of the united states may not enter merchandise for consumption unless it. The role of importer of record was created by customs and border protection cbp to further secure imports from terroristic threats and assure the payment of duties on all imported goods. They normally import their products from countries like guatemala mexico and argentina.

The requirements and procedures permitting a non resident company to act as an importer of record are simple and for the most part are the same as those that.