98 Ein Foreign Trust

Foreigners would greatly benefit from a 98 ein since no social.

98 ein foreign trust. The foreign 98 ein starts with 98. Murbury empire 8 348 views. Generally the grantor trust rules in the code dictate when the income of a trust will be taxed to the grantor of a trust or some other person regardless of who in fact receives the income. Trust taxation in general trusts are fiduciary arrangements created.

Tax purposes trusts are taxed as grantor or non grantor trusts. It is the first soi study of these returns since the 1996 modifications to the law 6. Foreign private trust 98 ein pt 2 duration. 671 679 and its income and capital gains are taxed to the grantor as if the assets had.

These rules are based upon whether the grantor has retained any of an enumerated series of economic interests in the trust or. If you already applied for a 98 ein number under a specific name such as john h doe the irs will not allow another foreign trust be created under that name unless you choose to name your foreign trust under a business name that was not used to before to setup a foreign trust. Connecting the dots on law of jurisdiction private public the term meaning of the united states or several states. The term foreign trust means any trust other.

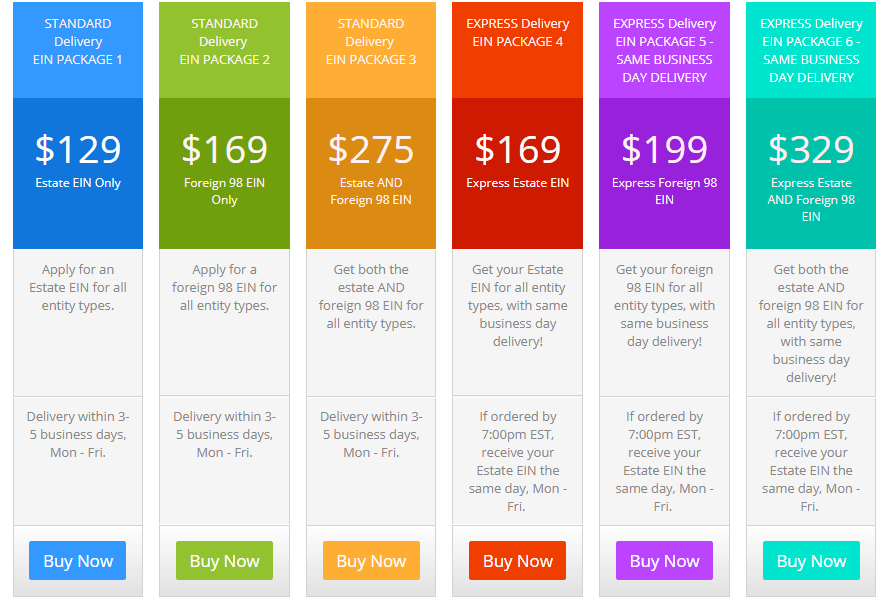

Mailed and faxed forms ss 4 from foreign entities are assigned ein prefix 98 and are only processed by the cincinnati international unit. 5 things you must do before getting a ein number why. To get an ein you usually need an ssn or an itin. An employer identification number or ein is an identification number issued to organizations to identify who must file a business tax return.

The irs allows one 98 ein number per entity. The 98 ein is called a foreign grantor trust because you are creating that 98 ein as a trust where you take trusteeship. No special characters. Which leaves foreign individuals who can t obtain either wondering how to get an ein without an ssn.

For those who prefer not to use their social security number to get an ein a foreign 98 ein is best suitable for them. I it is revocable by the grantor either. Foreign trust returns forms 3520 and 3520 a filed with tax periods ending during calendar year 1998. When the grantor retains an incidence of ownership over the assets transferred to a trust it is treated as a grantor trust under irc sec.

Person more limited rules introduced by the 1996 small business act apply in determining whether the trust will be treated as a grantor trust. How is a foreign trust taxed by the us.