Irs Depreciation Foreign Rental Property

Let s say i have 5000 rental income and 500 expenses to deduct.

Irs depreciation foreign rental property. Now that you know for certain the so called experts didn t even get the depreciable life of foreign rental property correct we move back to code section 168 g 1 a. Tax free exchange of rental property occasionally used for personal purposes. Other bonus depreciation property to which section 168 k of the internal revenue code applies. We have rental property abroad and are paying income tax for the rental income to the foreign country.

Foreign rental property depreciation irs income rules. In other words a person can depreciate the value of a property residence when it is being used for rental purposes in order to temporarily reduce the gross income. However i am required to also depreciate the rental property over 40 years. One benefit that the u s.

Lamagno the united states supreme court in a 5 4 decision explained that courts in virtually every english speaking jurisdiction have held by necessity. Property for which you elected not to claim any special depreciation allowance discussed later. Foreign rental property depreciation income. Property converted from business use to personal use in the same tax year acquired.

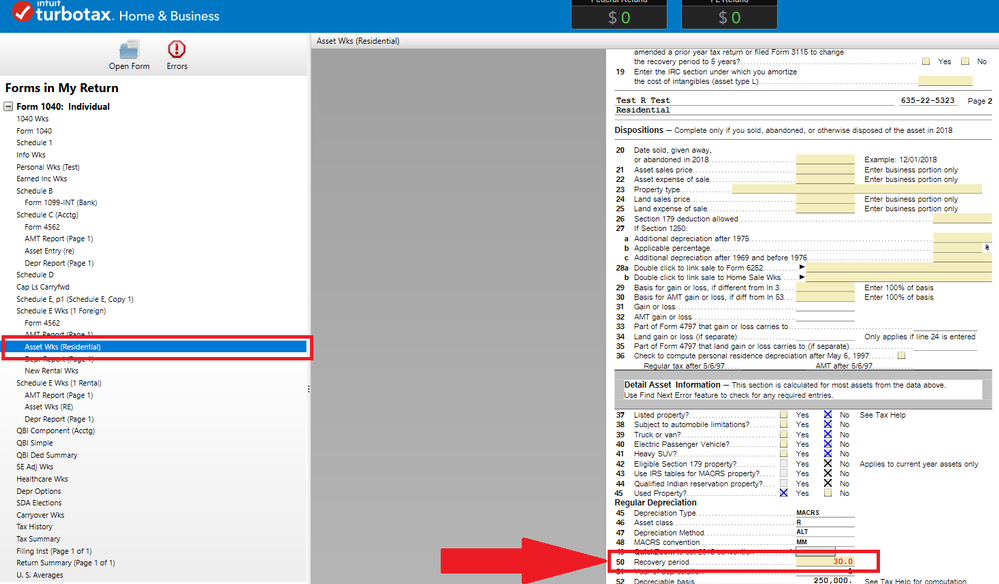

The united states is one of the few countries that taxes u s. Regardless of whether foreign residential rental need to use ads or gds 2018 irs publication 527 states at the bottom of page 9 comment 1 that property that was places in service after 2017 should be depreciated over 30 years. If you meet certain qualifying use standards you may qualify for a tax free exchange a like kind or section 1031 exchange of one piece of rental property you own for a similar piece of rental property even if you have used the rental property for personal purposes. The only stipulation is that the new rental property you acquire cannot be within the united states to be eligible for the 1031 exchange.

Tax system provides to both u s. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value. Property placed in service and disposed of in the same tax year. In other words the irs allows a depreciation expense.

Persons on their worldwide income. The difference is that foreign rental property depreciation is calculated over 30 years rather than the 27 5 used for us property. So a foreign rental property bought for 300 000 with annual rental income of 30 000 and allowable annual expenses of 10 000 a further. Person has foreign rental income from a property outside of the united states that income is taxable and reportable on a us tax return.

And foreign rental property that many other countries do not provide is the idea of depreciation. Foreign rental real estate however uses the alternative depreciation system which is calculated slightly differently. We can claim foreign tax credit for that so all good there. Let s also say i will make 1500 depreciation per year i will then end up with 3000.

Foreign rental property depreciation.