Do I Have To Report Foreign Pension Income

The contributions you make to the plan are not tax deductible for u s.

Do i have to report foreign pension income. If you paid any tax on foreign income in your respective country you may get a tax benefit from the us government but there is also a limit of exclusion for foreign income. If the amount was paid at various times throughout the year use an average annual exchange. Foreign pension plans generally will not qualify for special tax treatment like a u s. If the amounts on your foreign income slip are reported in a foreign currency convert them to canadian dollars before you enter them.

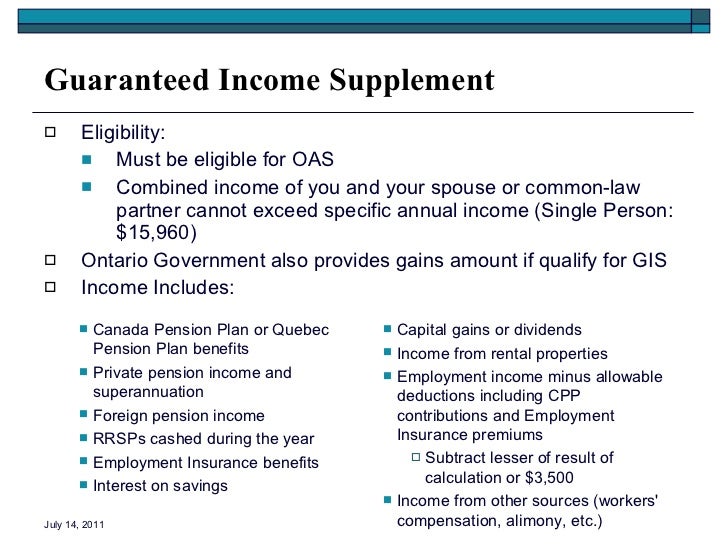

The reporting requirements for foreign pensions are often complex as additional requirements may exist on top of reporting employer contributions to foreign pensions and income earned from the pensions on your us tax return. It does not matter whether the income was a one time lump sum payment or an annual ongoing pension stream of monthly payments. Treaty benefits for pensions annuities general rule. United states individual retirement arrangement ira.

It still gets reported and taxed the same. If you paid foreign taxes on your pension you may be able to claim a foreign tax credit when you calculate your federal and provincial or territorial taxes see line 40500. Alternatively and also preferably as well because it is easier to do you can enter the foreign pension income on form 1040 line 21 as other income or foreign pension. The employee beneficiary must report the annual income earned in the plan on his or her u s.

Citizen or resident during tax year you likely have foreign income that you must report on your tax return. Income tax purposes and in certain situations you may be taxed on the annual growth in the plan even if it is not distributed to you. You will need to determine which tax years the income amounts align to and apportion them accordingly. Two common types of foreign pension are.

As a general rule the pension annuity article of most income tax treaties allow for exclusive taxation. You must submit income pension and any other amounts in turbotax even if your amounts aren t reported on t slips. If you are a u s. You may need to report your foreign income and associated tax offsets in multiple tax returns in australia.

Income received from foreign pensions or annuities may be fully or partly taxable even if you do not receive a form 1099 or other similar document reporting the amount of the income. You may also need to utilize the following forms depending on your specific situation. Maybe if your foreign retirement plan is located in a tax treaty country like germany canada rrsp rrif the netherlands uk or belgium your foreign retirement plan may not be taxable until distribution although there are likely reporting requirements. Reporting your foreign income.

Unlike australia most countries do not have an income year ending on 30 june. 401 k or traditional ira.