Texas Foreign Entity Registration

And 2 the date and cause of the revocation.

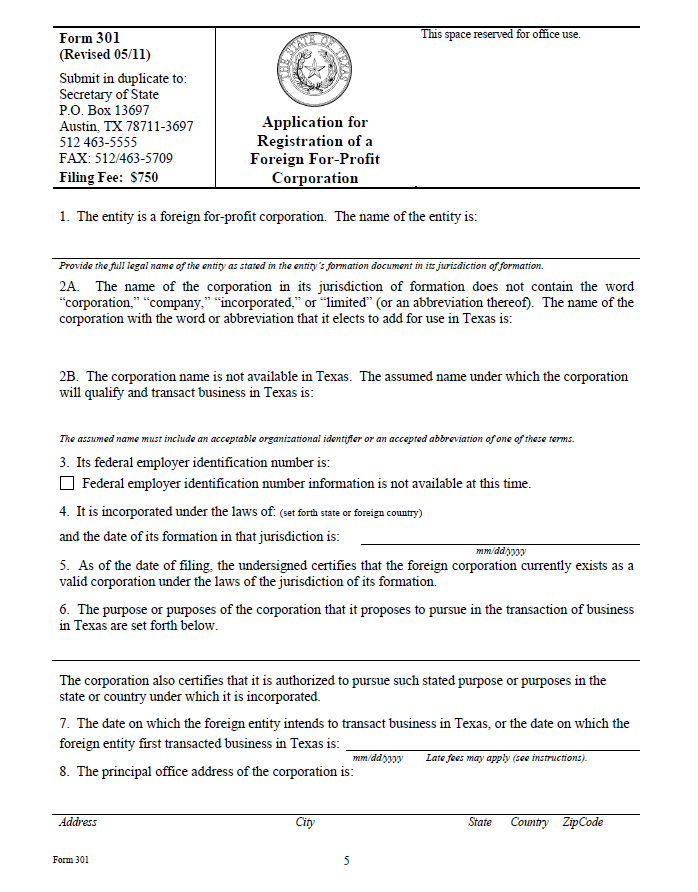

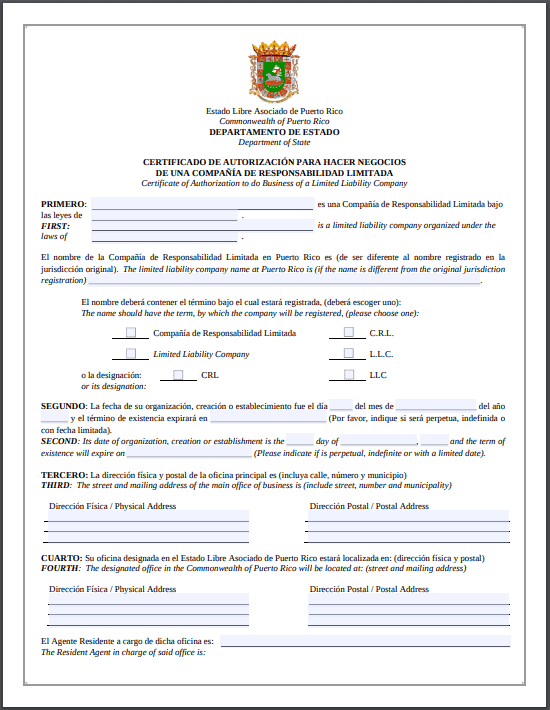

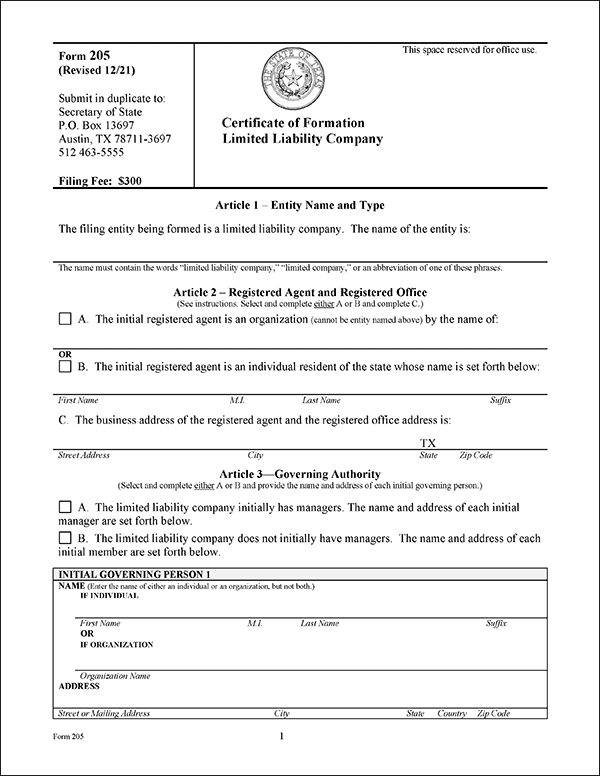

Texas foreign entity registration. Its use in texas due to a conflict with a previously existing name the foreign entity must obtain its registration to transact business under an assumed name that complies with chapter 5 of the boc. An application for registration formerly called a certificate of authority is filed by a foreign corporation limited liability company limited partnership limited liability partnership professional association or other foreign entity as listed in section 9 001 of the texas business organizations code when the entity will be transacting. State the assumed name that the foreign entity elects to adopt for use in texas in item 2b of the certificate. Any business entity actively engaged in business in texas must register with the secretary of state by filing a form called an application for registration.

A foreign entity that registers to transact business under a fictitious name is stating that the entity will transact business in texas under that name. Registering your company as foreign entity in texas. C except as otherwise provided by this chapter the revocation of a. For texas purposes if your llc is formed in another state then it is known as a foreign llc in texas.

A foreign entity registering under a fictitious name must file assumed name certificates with the secretary of state form 503 word 125kb pdf 74kb and the appropriate. A foreign llc registration will not be processed without the appointment of a texas registered agent. State the assumed name that the foreign entity elects to adopt for use in texas in item 2b of the certificate. Registration under prior law.

Boc 9 004. Once the application for registration is processed your llc will need to file a franchise tax report each year by may 15 and pay the applicable tax. 05 11 of pages 8 word pdf. If your company is registered outside of texas it is required to obtain a certificate of authority before transacting business in the state.

Texas law refers to these businesses collectively as foreign entities what is a foreign llc. An entity cannot serve as its own registered agent in texas. Business trust real estate investment trust or other foreign entity application for registration application by business trust real estate investment trust or other foreign entity with limited liability to transact business in texas. In other words foreign doesn t mean from another.

Its use in texas due to a conflict with a previously existing name the foreign entity must obtain its registration to transact business under an assumed name that complies with chapter 5 of the boc. Instead texas has a set of laws that cover registration of foreign businesses generally.