Can You Do A 1031 Exchange With Foreign Property

Internal revenue code section 1031 subsection h provides the specific rule regarding the exchange of foreign property.

Can you do a 1031 exchange with foreign property. Before i get into the details of a 1031 exchange of foreign real estate i should point out that united states citizens pay u s. This means you can exchange your rental property in panama for an office building in colombia or france if you like. Whenever you sell a business or investment property and you have a gain you generally have to pay tax on the gain at the time of sale. You can do a 1031 like kind exchange with u s.

1031 h foreign property. For foreign exchange or vice versa. You also must hold both properties for business productive use in a trade or investment 26 u s c. You can t do u s.

Property or with foreign for foreign property. Here s what you must do to ensure that the transaction qualifies as an offshore 1031 exchange after you sell your foreign real estate property. Remember that in order to qualify for tax deferral the exchange must be of like kind property. You can exchange a piece of factory equipment for another piece of factory equipment or you can exchange a commercial building for a residential apartment building.

Tax on any gain from the sale of real estate. Irc section 1031 of the u s. The rules on foreign exchanges are set out in i r c. The replacement property can be acquired from a related party if the related party is also initiating a 1031 exchange.

Tax code that allows for investment property real estate or otherwise to be exchanged for similar investment property. A 1031 exchange of foreign real estate allows you to exchange one foreign property for another with the same tax benefits. Tax code provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like kind exchange. To defer paying capital gains taxes using a 1031 like kind exchange your replacement property must be of the same kind as the property sold.

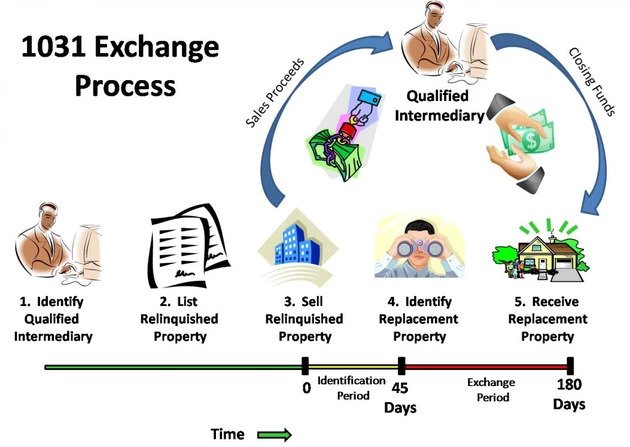

In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. A 1031 like kind exchange is a part of the u s. Specifically it makes clear that while foreign property can be used in a 1031 exchange neither foreign real property nor foreign personal property can be exchanged in like kind for us. Property and take the capital gains tax hit then use the proceeds to buy something overseas.

If you are considering a 1031 exchange of foreign based real or personal property atlas 1031 provides the accommodation services compliant with internal revenue code section 1031. In 1031 h congress made it so property located in the united states and property located outside the united state.